The land where we grow our food on, the water that flows through it, and our vast oceans are the birthplace of all life on earth. These landscapes and all animal and plant life it encapsulates represent our natural capital - the inherent value of our ecosystems, species, and everything we rely on to persist on this planet. Our systems of natural systems are declining fast, and this threatens our future. It puts at risk the continuation of any business with a complex supply chain and jeopardizes the resource availability of any nation.

The Natural Capital (NC) movement attempts to halt and reverse this trend by embedding the value of natural systems into economic systems. This article discusses how Natural Capital works, the pitfalls and opportunities of such a system, and how we can protect and accelerate its implementation through government and business.

While there is debate about NC as a concept, it is one of the few answers we have. Organizations worldwide are moving to implement it because of rapidly increasing ecological destruction. But there is much to be done, and progress is slow. There are opportunities to accelerate and improve Natural Capital based on innovative systems solutions for business and policy alike.

Solutions that not only conserve nature put the front runners of NC in a position of significant advantage in terms of both business and policy.

Why Natural Capital?

The concept of Natural Capital has been around for more than a century and is not without controversy. The debate about its ethical foundations has been going on for decades, raising ethical questions without clear answers, but the global decline of nature pressures us to take action.

Nature currently has limited economic value, causing it to be sacrificed all too often. This 'tragedy of the commons' plagues conservation efforts and the ongoing debates have delayed solutions and continues to result in preventable losses.

At the 2013 World Forum on Natural Capital in Edinburgh, organized by the Scottish Wildlife Trust, most policy and business representatives agreed it's time to take action, putting the ethical discussion into the background. Barry Gardiner, UK shadow minister for the environment, said it most poignantly:

What mechanisms make Natural Capital work?

The solution supported by the most prominent NGOs introduces national NC profit and loss balance sheets in each country and company and tracks this balance as is done with finance. These balance sheets express Natural Capital in terms of quantity and quality of resources (amounts of forests, water, biodiversity, etc.) and, where possible, as currency. For every asset that disappears from the balance sheet, something else must be brought back.

This function increases awareness and transparency about the state of our natural resources and improves their management. When successful, Natural Capital Accounting (NCA) injects a balancing system for our planet’s physical limits to growth in an economy currently aimed at capitalizing on limitless growth.

Implementing Natural Capital is not without risk, as demonstrated by the carbon credit scheme that often creates perverse incentives, shifting damage from one place to another due to incomplete valuation. To prevent this, NCA needs to take into account the full spectrum of values we recognize today and leave room for values that appear in the future.

Values that cannot be expressed in a monetary equivalent need to appear on the balance sheets in their qualitative form. It will not be possible to account for all value, but this should not hold us back. As Professor Dieter Helm explained at the forum in Edinburgh:

How do we value nature?

This lack of a pricing mechanism is the greatest challenge to the concept of Natural Capital. What value does a tree have? Ask a hundred scientists and economists, and you will get a hundred different answers. For NC to work, we need to agree on a basis for its valuation.

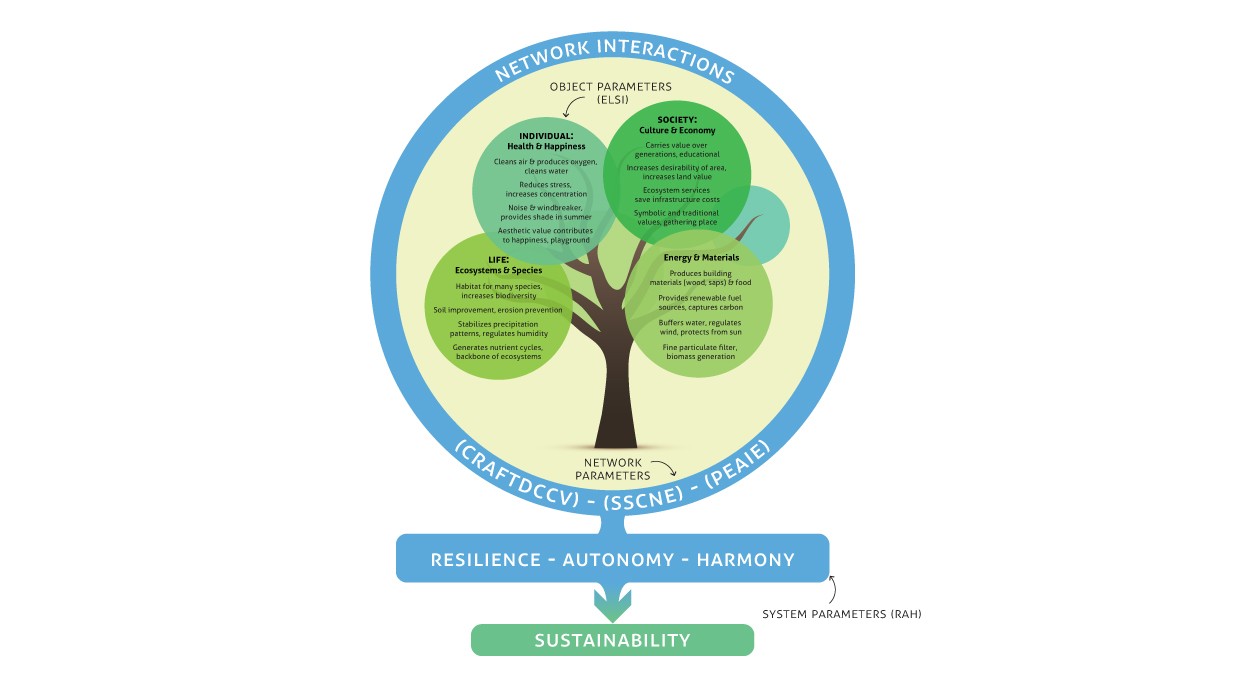

A tree is worth more than just the price of its wood, as it provides a home to many animals, acts as shade in summer, buffers and filters rainwater cleans the air, and supplies several other ecosystem services. It may also be valuable in other terms, for example, culturally and for its role in the ecosystem.

Therefore, the value of a tree isn’t the same as the price of its wood in the store and should be expressed differently. For example, referencing liters of water buffered and filtered, its contribution to biodiversity and well-being, and so on.

Quite a few studies have attempted to account for some of these values and converted them into currency. Research conducted by Johnson and Wardle gave the Canadian Boreal forest a value of US$ 3.7 trillion for all its ecosystem services and carbon sequestration. Another study from 1997 by Costanza et al. put a price tag of US$ 33 trillion on the world’s biosphere’s ecosystem services. These and other studies give starting points for value estimation, while there are significant gaps to cover. A more inclusive framework to assess value is necessary to find and fill these gaps.

SiD provides a structure for nature's valuation

The Symbiosis in Development (SiD) systems analysis framework is such a tool. SiD can be used to assess the full spectrum of value for any given subject, including the relational values of the system as a whole. Its flexible structure allows room for future discovery while providing clarity to start valuing with limited insight today.

Using SiD, the value of the tree can be seen on three 'scales': the object (direct physical) value, the value of its network (services and relations), and its systemic value as a whole. The first is the easiest to assess, and the last is the hardest but has the most impact. Combining these three scales provides a holistic estimation of the tree's Natural Capital value.

Using SiD, there are opportunities for other values to join the party, such as transparency, diversity, health, and well-being. SiD reserves room for these values, allowing them to be slotted in once research makes them available.

Because of its universality, the SiD framework works for other measurements, allowing it to be inclusive of other movements, such as social justice or poverty alleviation, and stand stronger together.

This flexibility prevents the system from becoming solidified once adopted, preventing perverse incentives that occur when real value and value in the system are dissonant (an issue that plagues carbon trading). Tracking the flexibility of the Natural Capital system is therefore essential.

Giving Natural Capital teeth

There are frameworks for valuation, which can be filled in using existing research. Then incentives are needed for organizations to implement them. Using systemic innovation strategies, the most effective approaches can be recognized and explored. As a trial, a small interdisciplinary team at Except, a sustainability strategy firm, held a short systems exploration session and came up with a few approaches. It was discovered that effective solutions make Natural Capital a base economic requirement for growth, rooting it into the economy's core.

One approach is to create a secondary currency backed by Natural Capital rather than gold. This would mean Natural Capital is not expressed in Dollars, Euros, or Yen, but in its own "currency." For example, somewhat tongue-in-cheek, calling it the "GreenBack."

This currency is purely digital, relying on similar technology as BitCoin, and coupled to the balance sheets of nations, capturing both qualitative and quantitative values in separate indicators. When demand for this GreenBack increases, an immediate increase in demand for Natural Capital results. This creates a natural marketplace where the only way to grow wealth is to raise Natural Capital. This currency thus couples economic growth with its necessary precursor: the resources our planet needs to sustain economic growth.

Solutions like these accelerate the implementation of Natural Capital, but business and government have their own challenges. What are the opportunities for countries and companies to implement NC?

Opportunities to accelerate NCA in policy

Several projects researching the role of NC in policy are underway, for example, TEEB, a global research project through the European Union. But progress is slow, hampered by a lack of oversight, tools for valuation, accessible knowledge databases, and stakeholder awareness. These challenges can be more effectively solved with innovative systems thinking than traditional approaches, saving resources and time.

Time is of the essence. One way to speed up the process is to apply distributed innovation mechanisms, such as crowd-solutioning and serious gaming. These approaches have managed to resolve in weeks highly complex problems, such as unraveling the secrets of protein folding, which previously took teams of scientists many years.

Suppose strategies such as these were to be applied to the issues that hold back Natural Capital. In that case, solutions could be implemented at a much faster rate, and Natural Capital Accounting could be in place in many countries within the next decade.

But, Natural Capital can only be effective if it's adopted voluntarily by both government and business. Enforcement takes too long, and the stick causes loopholes while the carrot accelerates the process. Why would a profit-driven company be interested in implementing and investing in Natural Capital?

Advantages of embedding NCA in business

At first sight, a business may not seem to have an interest in Natural Capital or Natural Capital Accounting, as it does not directly lead to profit. But there are several reasons why this is not only advantageous but critical to the survival of business today and tomorrow.

In complex supply chains, change comes quickly and strikes hard. Most companies rely on one or more natural resources somewhere in their supply chain, yet may not be aware of where and how. Tracking NC is essential to ensure continued business in the short and long term. If a sizeable company is not tracking this, it is not conducting proper risk management.

In addition, businesses can use NC to find valuable ecosystem services while improving CSR performance at the same time. For example, companies have found bio-based alternatives to artificial or fossil resources that save money and provide long-term sourcing security.

It is also suitable for businesses to be ahead of the curve regarding issues that governments will eventually demand—waiting to be forced into something through regulation risks costly solutions being enforced. Also, being one of the first to start NC accounting has its perks. It allows an organization to shape the conversation, be more opportunistic with investments, and get public recognition for leading the good fight.

This approach has been highlighted by Puma, which started publishing the first Environmental Profit & Loss Account (EPLA) under the direction of their holding company Kering, and already tracked 145 million in environmental impacts in 2010. This resulted in positive press globally, several companies following suit, and creating a catch-up game for everyone else.

Lastly, insurance companies are becoming interested in Natural Capital Accounting. After all, threats to resources that a company relies on are threats to the company, and insurance will go up or become unavailable. And it is not just insurance firms. Standards & Poor’s, one of the Big-Three credit rating firms, is investigating Natural Capital Accounting as a new input for the same reasons, directly affecting a company’s credit rating. That should be reason enough for the big players to start moving.

Making it happen

There are many reasons to start implementing NC as fast as possible. A structured and systemic approach is critical to make it succeed. This is why solutions like SiD exist. We call on the front runners of NC to aim higher and gain the advantage of using innovative systems tools and implementation strategies, such as natural currencies, crowd-solutioning, and systemic risk assessment. The front runners in policy, business, and NGOs should be brought together to accelerate the process and support each other collectively. It is in our joint interest to do so. We have the tools, expertise, and manpower to do this, so let’s make Natural Capital accounting a reality within a few years and gain significant benefits for both organizations and society alike.

Jan. 27, 2018