To realize a sustainable society, we need to address our bruised environmental and economic systems in their entirety. For that to happen, vast and profound systemic changes must take place. Impact investing has offered us a lifeline and is experiencing rapid and unforeseen growth. However, as more sustainably-hopeful investors enter the market, it's worth considering: is it producing the outcomes we need?

Despite best intentions, we see impact investments having little effect in changing systemic failures and are akin to moving deck chairs on the Titanic. In contrast, now the iceberg has been spotted, systemic investments focus on transitioning entire economic systems and changing the ship's direction.

This article covers the differences between impact and systemic investing and outlines why systemic investing is vital to help us realize a sustainable future. It concludes with a step-by-step guide for organizations and individuals considering systemic investments.

Written by Tom Bosschaert, Sonia Gholami, Nick Liasovskyi, Alexandre Fradet, and Mark Ratcliff

How sustainable is impact investing?

Impact investing only emerged a few decades ago, with the term officially coined in 2007, popularized by the mantra: "purpose in addition to profit." Impact investors invest in companies that offer products or services to address some of our most unsustainable actions. Generally, these regard things like energy production, water, agriculture, finance, and education.

Following are a few examples of the types of ventures that attract impact-driven investors and sustainably-focused funds:

D.light

An American social enterprise providing affordable, reliable energy for people across the developing world. Since 2006 they have sold over 20 million solar lights and transformed 100 million lives with a business model valuing innovation, honesty, and optimism.

Natgas

A Mexican company founded in 2012, focusing on natural gas as a clean green fuel alternative. They have converted over 27,000 vehicles, actively promoting the state of Querétaro to adopt 100% natural gas public transport within the next ten years.

Ball Corporation

An American company aiming to replace single-use plastic with aluminum - a more recyclable and sustainable material. By 2030, they aim to reduce operational emissions by 55% and at least 16% across their entire value chain.

Investing money into sustainable companies like those listed above has moved well beyond a trend. At the end of 2020, the Global Sustainable Investment Review reported that worldwide sustainability-focused investments and assets totaled about $35 trillion. This value represents a 40% surge in sustainable investments from five years prior and a 36% share of total managed assets.

With approximately 4,000 funds currently investing in sustainability, there is hope for advancing a more responsible investment model. Unfortunately, focusing on impact alone will not produce the widespread actions we need for systemic change.

What is systemic investing, and how does it help?

Almost all businesses with a "clean" or "green" product or service are company-centric, albeit often driven by altruistic, socially responsible, and tangible goals. Critiques of impact investing outline that targets set by such companies are usually too narrow and ignore anything outside their defined goals.

For example, suppose an impact investment focuses on reducing the carbon footprint of a product. Maybe, this particular product could be replaced by a service, or there may be another company that is far more effective at producing them. It's unlikely that these questions would be asked. By not assessing the entire system, impact investments tend to lock in actions, preventing systemic and potentially more beneficial transformations.

Since impact investment rarely looks at these effects, it more often than not contributes to "greenwashing" - perhaps the worst label one could place on a company claiming to be sustainable.

Systemic investments regarding EVs

Let's look at an example of replacing all petrol-engine cars with electric. An impact approach may consider a reduction in emissions as a key metric. Sometimes, it's to replace a certain number of gasoline-powered vehicles each year.

A systemic strategy would move one step further and consider how these actions may cause unwanted effects elsewhere. By acknowledging resource scarcity, increased energy demand, and strains on infrastructure, a more systemic approach may prevent the need to manufacture many of these additional electric cars in the first place.

By considering how the impacts across society, a systemic investment would support companies that adopt work-from-home solutions, public transport, or develop software and policy solutions. As it's systemic, they're likely to invest in electric vehicles too.

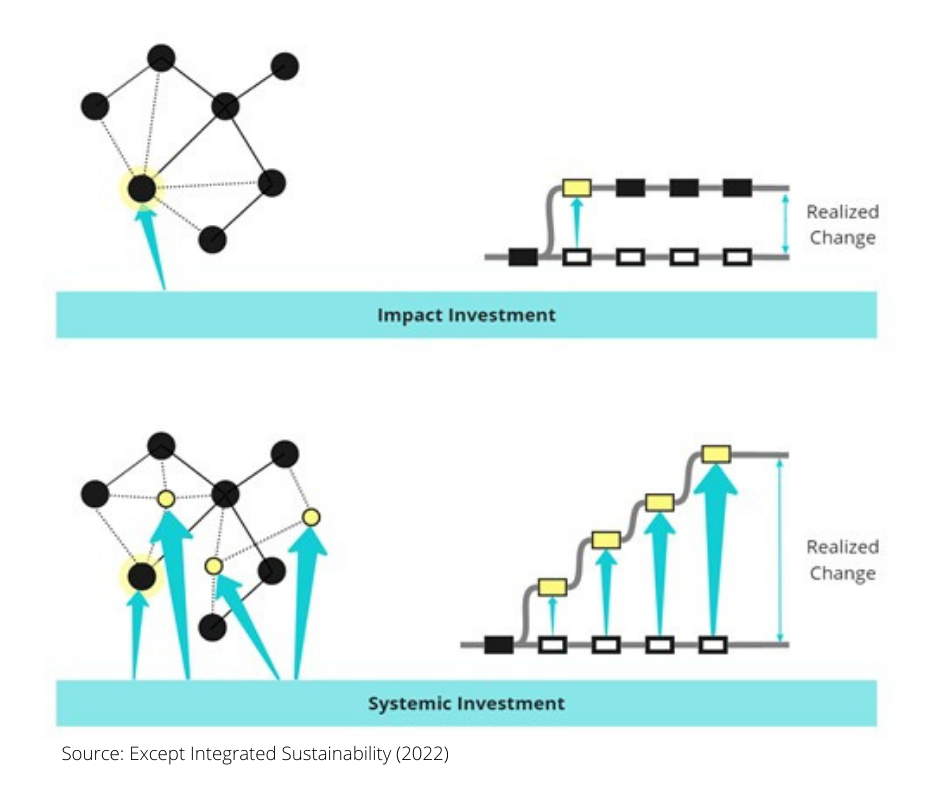

Instead of directing capital into a few unrelated companies, systemic investments disperse capital to organizations and initiatives across the impact chain, contributing to more significant and positive societal change.

A company genuinely driven and aiming for sustainability should be concerned with how it operates in the systems they are embedded. This means supply chains, neighborhoods, wider communities, country's cultures, and economies, just to name a few of the most apparent examples.

With this approach, an investment group can offer a full-service solution - electric cars for workers whose presence is essential and work-from-home technology for others. This saves money, resources, and time and has a much more significant effect than replacing all petrol cars. This positive impact could produce the long-term benefits and systemic change we need.

A comparison of impact vs. systemic investments

To help clarify, let's look at a few examples of common societal problems, including the electric vehicle example, and how different a systemic investment approach would be:

Reducing carbon emissions and curbing global rises in temperatures

- Impact investment: invest in an electric vehicle company

- Systemic investment: support work-from-home software and policies, shared ownership models, public transportation, responsible energy providers, battery resource mining facilities, part suppliers, etc.

Enhancing biodiversity and ecosystem services vital role

- Impact investment: invest in a company selling easy-to-maintain beehives

- Systemic investment: support agroforestry agriculture, chemical-free timber treatments, organic pest control producers, etc.

Dealing with sea-level rises and flooding

- Impact investment: invest in a company producing gabions for erosion prevention

- Systemic investment: support long-term migration policies for sensitive coastal areas invest in climate-proof neighborhoods, mangrove rehabilitation programs, etc.

The widespread benefits of systemic investing

Systems thinking (and investing) gives a bird's-eye view of all the causes and effects within any system. This makes it easier to recognize components, their interconnectedness, and avoid typically unexpected consequences.

As a side effect, this enhances a system's adaptiveness and resilience. however, despite the many benefits and growing awareness of our challenges, systemic investments are still rare and there are few real-world examples and data to work with yet.

However, such a portfolio could be structured in a similar way to any Exchange-Traded Fund (ETF), bundling various grants, private equity investments, and project financing together. Usually focused on getting the highest returns possible, ETFs are generally quite broad regarding the types of companies they consider - especially in regards to goals and impacts.

The complex nature of systems thinking and likewise, systemic investments, entail many challenges, requiring asset managers to not only be able to recognize how a system works but to understand how and where to best disperse capital.

In creating systemic strategies, collaboration has always proven helpful with asset managers, either when creating a single portfolio, a company-wide systemic analysis, or into segmented investment areas to be taken up by individual managers.

Key steps in implementing systemic investing

Evaluating interrelationships between systemic risks is far from straightforward. Nevertheless, diving into the dynamics of a system can result in insights that can significantly improve uncertainty and ambiguity and help decomplexify systems.

The following outline is a brief overview of the necessary steps toward developing such a strategy:

1 - Define system boundaries

Before beginning to assess a system's entirety, it is crucial to define the scope of the intervention - otherwise known as defining a system's boundaries. This stage can have enormous and severe consequences for a systemic investment strategy.

An overly narrow view can result in misinterpretation and the exclusion of critical dependencies, leading to an incomplete and potentially dangerous investment. On the other hand, excessively broad boundaries can introduce unnecessary complexity and result in a tangled dynamic web.

2 - Analyze the system

A proper system understanding is achieved by identifying indicators, compiling data, and using systems analysis through real-world experience. This stage allows for a deep analysis of all objects and relationships and actively engages stakeholders in data collection and inventory design.

All causes and effects must be seen from different perspectives to provide an accurately objective understanding of a system and design a practical way forward. System mapping is a valuable and powerful tool in this process.

3 - Develop a theory of change (ToC)

This stage views the project from a broader perspective on how development happens. An effective ToC should be used as a compass, pointing the team in a general direction rather than a comparatively dictatorial map.

A ToC acknowledges complexity and non-linearity, allowing for flexibility, constant reflection, and changes to perspective and orientation. This step reveals individual, organizational and political behaviors and what aspects need to change.

4 - Build an investment roadmap

Once the theory of change is determined, opportunities can be more precisely identified and placed in an investment roadmap. Each investment's impact and areas of potential cross-relationships can now be relatively assessed and accounted for. The resulting roadmap is the list of interventions (assets) that lead to the system's desired state defined by the ToC.

5 - Monitor and Evaluate (M&E)

Systemic investment happens in complex and often unpredictable environments. Many factors can influence the system's evolution; therefore, a proper and frequent M&E of the strategy and state of the system is paramount. Accurate M&E processes will review the strategy performance based on the system's condition, and the insights will help to adapt and further develop the strategy.

A rising tide lifts all boats

Impact investing, despite its growth in popularity, has fallen short of delivering the societal transformations necessary to withstand our current socio-environmental challenges - not to mention those that lie ahead. Systemic investments aim to rectify the often vast gap between investment capital and systemic, sustainable outcomes, thereby supporting financial institutions and the broader economy to avoid uncertainty and enhance resilience.

The systemic approach ensures that single investments are part of an interconnected web of organizations working toward a common goal, averting risk and shrugging off the long-held notion that there must be a financial trade-off to doing good. It's much more likely that through systemic collaboration and support, the right impacts will organically emerge and create the long-lasting change to sustain life on earth as we know it.

March 20, 2022