As our modern environmental and social challenges become increasingly apparent, so does the understanding that we need to move beyond investment overly focused on impacts. Systemic investments (sometimes called transformational investments) focus on achieving practical and long-lasting benefits by transforming societal, industrial, economic, and organizational systems.

Except supports organizations to further understand how systemic investment works and help develop pathways to set visions, goals, and opportunities, and produce actionable roadmaps for organizations to realize long-lasting and sustainable change.

Shifting from impact-driven to systemic investments

In the first decade of the 21st century, the most pressing social and environmental circumstances of our communities have led to the emergence of the impact investment movement. Emerging around 2007, this investment approach focuses on generating measurable, social, and environmental impacts alongside ensuring a financial return.

Despite the noble cause, there is overwhelming evidence that such an approach is not enough to sustain the investment and the structure of companies or organizations. Instead, to address the most challenging issues of our time, we will need more than sole projects that despite having positive outcomes, only benefit a narrow part of society and the community in which they are based.

We need to better understand the totality of projects, organizations, supply chains, and the interconnected individuals within our networks and systems. To make significant, effective and sustainable change we need to rethink the operations within a system, not just their physical or most apparent elements. Because these changes are so broad and far-reaching, they will drive through a holistic and concerted approach.

This, rather conveniently and simplistically, sums up systemic investing and granting.

The Goals of Systemic Investment

Systemic investing generally aims to develop long-lasting and beneficial outcomes for all living things on our planet.

Its short-term goal is to protect and preserve our environment and natural systems to curb global climate change. In the longer term, it's driven more by the need to improve all outcomes across broader society. This includes, but is not limited to, creating better and more affordable places to live, just cities, fulfilling jobs, and resilient economies.

Please note: what is described as investment here also counts for granting and subsidy programs.

Strength in numbers: investing across supply chains

Systemic investment differs from impact investment in scale and ambition and its fundamental approach. Systemic investment is more holistic, meaning it's focused on investing in where a group

of like-minded companies working together, akin to a consortium, to achieve something that would be impossible for each organization.

An investment pathway like this, as one could assume, requires a much deeper insight into the complex web of interactions and improvements needed in a system.

Take a project focused on food production, for example.

Impact investment may focus on something like the CO2 footprint of a food manufacturer to determine the quality of the impact investment.

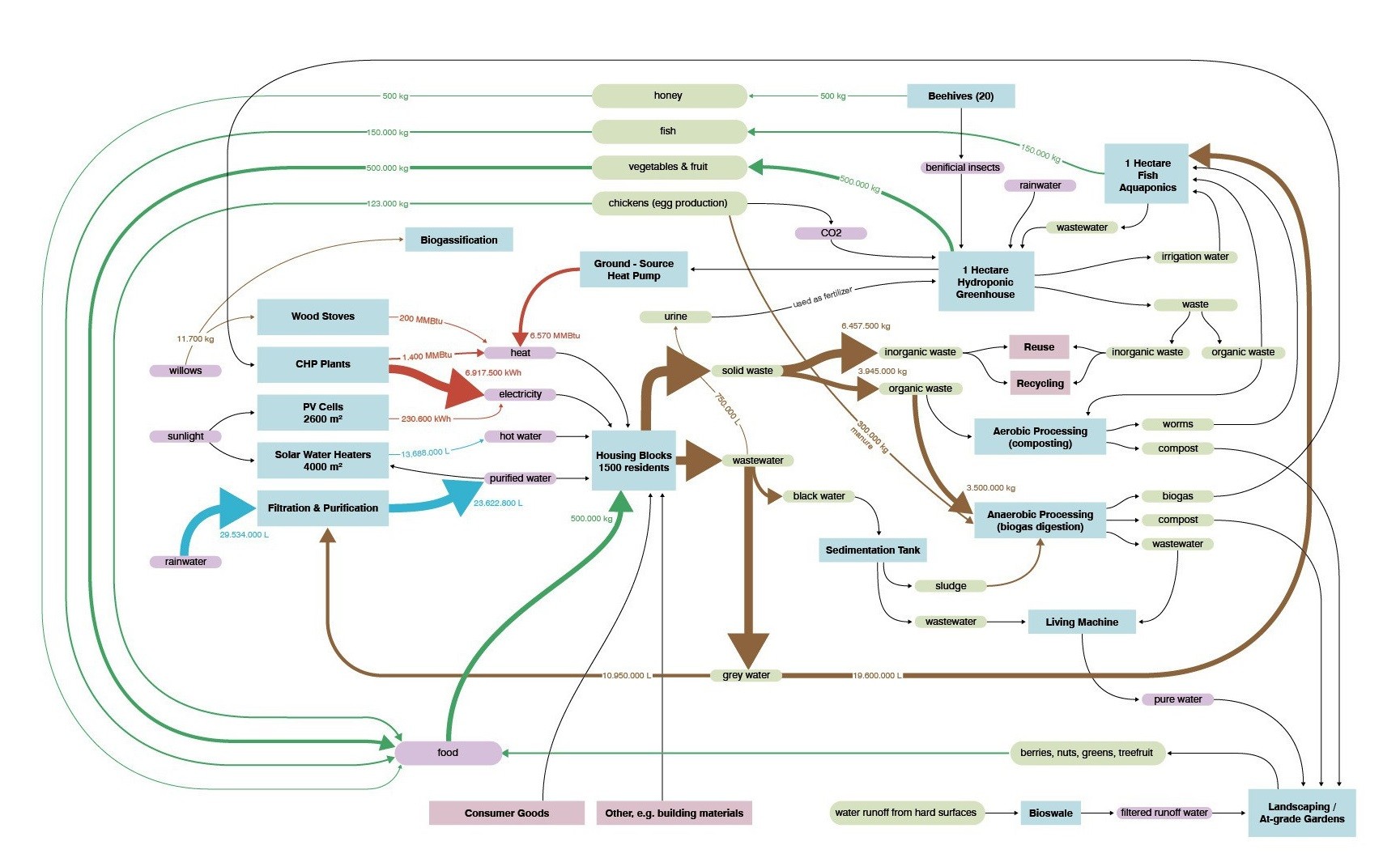

A systemic investor, however, would look at the consequence of the investment in the food system. They would likely not just invest in a sole entity in the transition chain but a range of them to help achieve a group-led systemic effect. In effect, that means the investment would not just influence the entity that produced the food but also the distribution and waste reuse outlets and would be more potent at influencing policy around healthy and affordable food.

By investing more broadly across a network or of companies working collectively toward a common goal, the benefits are spread across the supply chain, which enables more impactful outcomes and an increased return for the investor.

A step-by-step approach to gaining systemic insight

When we support organizations in assessing their systemic investments or grantmaking programs, we work through the following steps:

1 Create systemic insight

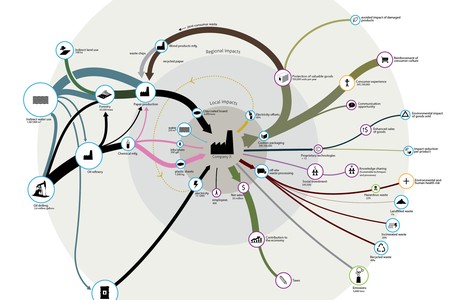

To encourage systemic investing, we need to have insights into the constituents and dynamics of the system. To do this, we utilize Symbiosis in Development (SiD), our open-source and holistic systems thinking and mapping methodology. It helps to create deeper insight, research, indicators, and data and generates a more holistic overview of the system's current state. This approach is usually gained through co-creation with client teams and achieves a high standard of shared insight.

2 Identify system transition pathways and vision

Only from knowing the ins and outs of a system and its current state can we envision an alternative and design improvements. Each is unique; therefore, transition pathways will have alternative dynamics, costs, and benefits.

These factors can then be elaborated upon and developed into future visions of systemic states, usually supported by imagery and storytelling to better express. Based on these, we further explore transition strategies and requirements from stakeholders and action paths.

3 Carry out systemic investment identification

Upon choosing an intended transition pathway, we can further assess and select areas of intervention that help to effectively initiate the transition. This approach helps to identify concrete and investible actions across the system and stakeholders. Cross-relationships between individual organizations are found, acknowledged, and accounted for.

4 Build a systemic investment roadmap

Once a strategy sequence is in place, a roadmap can be built over time. This map aims to identify each sequential step, the timeframe at which it takes place, and to build resilience measures to reduce risks and enhance the chance of success. The roadmap also includes monitoring and reporting the process if needed

For more information about how we can help with systemic investments and grantmaking, contact us, or access our Online Consulting Service to get advice directly from one of our experts.

Case studies

Related Services