Over the past decade, ESG has become a buzzword in the corporate world. Companies proudly release annual ESG reports, investors rely on ESG ratings, and regulatory bodies are tightening requirements for ESG disclosure. At first glance, this seems like a victory for sustainability. However, there is a fundamental problem: ESG is not the same as sustainability, and understanding their difference is vital for company survival and resilience.

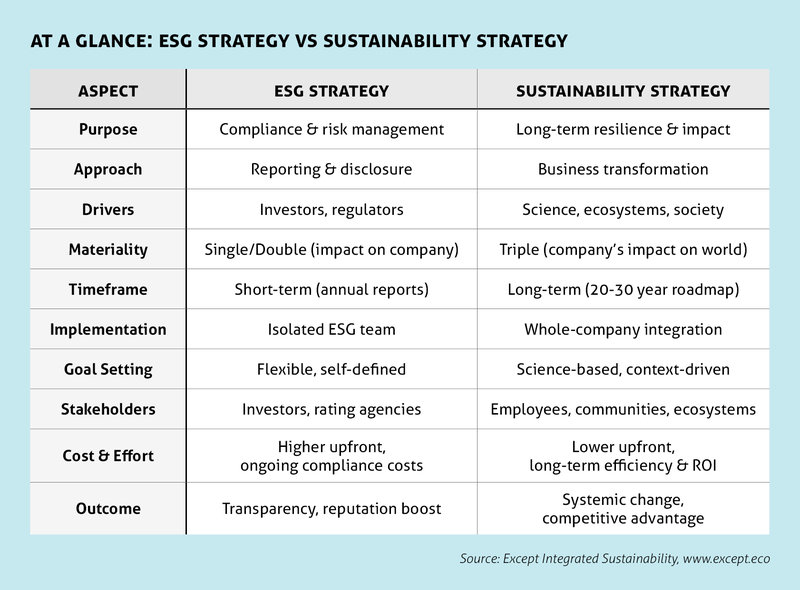

This misunderstanding is widespread, even among corporate sustainability officers and decision-makers. Many organizations believe that having an ESG strategy means they have a sustainability strategy—but the two serve very different purposes. ESG is a financial risk management tool designed for investors, while a sustainability strategy is a long-term transformation roadmap aimed at aligning business activities with ecological and social boundaries.

Mistaking ESG for a Sustainability strategy is a vital mis-step and exposes the company to vast risk and misses out on enormous opportunity and potential. So why is this distinction so often blurred?

Why the Confusion Exists

- Overlapping Terminology

ESG and sustainability both address environmental and social issues, but they do so in different ways. ESG focuses on measuring and disclosing risks that could affect a company’s financial performance, while sustainability strategy is about fundamentally redesigning how a company operates within planetary and social limits. - Corporate Marketing & Greenwashing

ESG is driven to a large degree by accounting offices like the big 4; KPMG, Deloitte, EY and PwC. It is in their interest to sell ESG services, as they have invested enormous resources in these services as a pivot from traditional accounting which is becoming obsolete. For example, KPMG invested over $1.5 billion in ESG services over 3 years. The resulting marketing from these powerful entities has flooded the market, obscuring the reality that ESG often only drives up costs, and does little for the long term longevity of the organization. As a consequence, companies are driven to highlight their ESG efforts as proof of their commitment to sustainability. However, ESG metrics often allow for superficial or selective reporting—leading to greenwashing. A company may score well on ESG rankings while still engaging in harmful environmental or social practices. - Regulatory and Investor Pressures

Governments and financial institutions increasingly require companies to report ESG-related data. This has led to a surge in ESG compliance efforts, reinforcing the perception that ESG is the primary framework for corporate sustainability—when in reality, it only addresses part of the picture. While ESG reporting certainly holds value when placed within a much larger strategic framework and effort, in and of itself it is of limited value.

The Risks of Mistaking ESG for Sustainability

When companies equate ESG with sustainability, they risk:

- Missing the bigger picture – ESG frameworks often focus on incremental improvements rather than systemic transformation. A company might reduce emissions slightly but fail to redesign its operations for long-term resilience. This misses both upcoming risk, as well as opportunities to become a transformative market leader.

- Falling into compliance traps – Companies may spend vast resources on ESG reporting, only to realize later that it does not lead to meaningful change or competitive advantage. As ESG frameworks change often, this may be of short-lived benefit.

- Ignoring critical impacts – ESG strategies prioritize issues that matter to investors rather than those that are scientifically or ethically urgent. For example, an ESG report may focus on climate risk disclosure without addressing the company’s actual contribution to climate change. This opens up companies to large upcoming regulatory risk, as well as wasteful spending on ESG aspects that do not really matter.

The bottom line? ESG is useful for transparency, but it does not create sustainability. For organizations truly committed to a future-proof business model, a sustainability strategy—built on systems thinking and frameworks like Symbiosis in Development (SiD)—is essential.

2. Origins and Purpose: Where Do They Come From?

To understand why ESG and sustainability strategies differ so significantly, we need to look at their origins. While both concepts deal with environmental and social issues, they emerged from entirely different worlds, serve different stakeholders, and are built on distinct foundations. Sustainability strategy goes back as far as the 1960s, but let's start with the younger of the two: ESG strategy's origins.

2.1 ESG Strategy: Born from Financial Markets

The concept of Environmental, Social, and Governance (ESG) emerged from the financial sector, specifically as a tool to help investors assess corporate risk. The term was first introduced in 2006 within the United Nations’ Principles for Responsible Investment (PRI), which encouraged financial institutions to consider ESG factors when making investment decisions. The idea was simple: companies with strong ESG performance were believed to be better long-term investments because they managed risks related to environmental regulations, social unrest, and corporate governance failures. Note here that this did not include reducing the company’s actual impact on these factors.

Over time, ESG developed into a vast ecosystem of reporting standards, including:

- Global Reporting Initiative (GRI) – a framework for sustainability reporting.

- Task Force on Climate-Related Financial Disclosures (TCFD) – focused on climate risks for investors.

- Sustainability Accounting Standards Board (SASB) – industry-specific financial materiality disclosures.

- International Sustainability Standards Board (ISSB) – aiming to unify ESG reporting.

- European Sustainability Reporting Standards (ESRS) – new mandatory EU reporting requirements.

While these frameworks provide transparency, they focus primarily on investor-relevant risks rather than sustainability outcomes. A company can score highly on ESG rankings while continuing harmful environmental practices—because ESG does not require alignment with planetary boundaries or social well-being. It only measures disclosure and risk management.

ESG’s Purpose:

✔ Provide investors with risk-related data.

✔ Enhance corporate transparency on environmental and social issues.

✔ Align businesses with regulatory and market expectations.

✖ Does not require a company to be sustainable—only to report on its risks.

2.2 Sustainability Strategy: Rooted in Systemic Change

In contrast, sustainability strategy did not originate from the financial sector but from scientific research, environmental activism, and systems thinking. It is built on the understanding that businesses operate within—and are dependent on—ecological and social systems. The goal is not just to disclose risks but to redesign businesses so they contribute positively to a regenerative and resilient future.

Key milestones in sustainability thinking include:

- Limits to Growth by the Club of Rome (1972) - established the first globally recognized risk analysis on resource limitations.

- The Brundtland Report (1987) – introduced the concept of sustainable development.

- Planetary Boundaries Framework (2009) – defined nine ecological limits that must not be exceeded.

One of the most comprehensive frameworks for developing sustainability strategies is Symbiosis in Development (SiD), developed by Except since 1999. Unlike ESG, which focuses on financial disclosure, SiD is a fully systemic framework that helps organizations integrate sustainability into their core operations. It provides tools for system mapping, scenario planning, and transition management, allowing companies to go beyond reporting and actively transform their business models.

SiD promotes taking action that helps both a company’s bottom line and long term vitality, as well as helping to transform the society it operates in. Setting up a sustainability strategy helps an organization to work towards becoming a driver of transformative change within society, and through this, increase its true value.

Some valuable frameworks related to sustainability strategy will rarely enter the picture when following a pure ESG strategy, such as Natural Capital accounting, True Value accounting, Circular Economy, or the Donut Economy.

Sustainability Strategy’s Purpose:

✔ Transform businesses into regenerative, future-proof systems.

✔ Align corporate actions with planetary boundaries and social needs.

✔ Move beyond compliance toward long-term resilience and competitive advantage.

✖ Not just about reporting—requires systemic change and business model innovation.

While ESG plays an important role in financial transparency, it does not ensure sustainability. A true Sustainability Strategy—especially one built using frameworks like SiD—goes far beyond compliance. It redefines the way companies operate, ensuring they contribute to a regenerative future rather than merely mitigating financial risks.

3. How They Practically Differ: A Tale of Two Approaches

Let’s have a look at the difference in practice between developing an ESG strategy and a Sustainability strategy.

3.1 Developing an ESG Strategy

An ESG strategy is primarily a reporting exercise, structured around frameworks like GRI, ISSB, SASB, and TCFD. It is designed to provide investors with risk-related disclosures, rather than ensuring sustainability.

Key Steps in Developing an ESG Strategy

- Identify Risks & Opportunities – Conduct a Materiality Analysis to determine which ESG topics are most financially relevant.

- Collect and Disclose Data – Measure carbon emissions, labor policies, diversity, energy use, etc.

- Set Goals – Often self-defined, based on investor priorities rather than planetary boundaries.

- Align with Regulatory Requirements – Ensure compliance with reporting standards and ESG rating agencies.

- Publish an ESG Report – Disclose data annually to investors and stakeholders.

The Problem? ESG reporting does not require companies to change their operations—it focuses on risk mitigation and compliance, not transformation. Since no ESG framework currently mandates a ‘triple materiality’ approach, more often than not an ESG strategy is entirely divorce from the needs and requirements for sustainable development. But that’s subject for another story for another time.

3.2 Developing a Sustainability Strategy (Using SiD)

Unlike ESG strategies, which are investor-driven and compliance-based, a sustainability strategy is about long-term transformation. Instead of simply reporting on the past, sustainability strategies actively redesign business operations to ensure they contribute positively to ecological and social systems.

The Symbiosis in Development (SiD) framework, developed by Except in 1999, offers a systemic approach to sustainability strategy development. It moves beyond ESG’s fragmented, checklist-based methods and integrates sustainability into the entire business model—ensuring companies become future-proof and regenerative.

Key Steps in Developing a Sustainability Strategy (Using SiD)

Step 1: System Mapping – Understanding Context and Connectivity

- Instead of isolating ESG topics (carbon, water, labor), SiD maps the entire system—examining how the business interacts with environmental, social, economic, and governance factors.

- This includes supply chains, resource flows, social impacts, biodiversity dependencies, and market trends.

- System mapping ensures that sustainability actions are not isolated fixes but part of a holistic transformation.

Step 2: Define Context-Based Goals

- Unlike ESG, where companies choose their own (often arbitrary) goals, SiD defines sustainability targets based on integrated sustainability planetary boundaries and societal needs.

- Instead of setting a general “Net Zero by 2050” goal, SiD asks: What is scientifically necessary for this company to operate within a safe ecological space?

- Goals are set for climate impact, biodiversity protection, circularity, social equity, and economic resilience—ensuring alignment with global sustainability imperatives, not just financial interests.

Step 3: Stakeholder Integration & Co-Creation

- SiD ensures that sustainability is not just an investor concern—it actively engages all stakeholders:

- Employees (workplace sustainability, fair labor)

- Communities (social well-being, local environmental impact)

- Ecosystems (biodiversity, regenerative agriculture, closed-loop supply chains)

- Through co-creation workshops, organizations design solutions that benefit all stakeholders, not just shareholders. These workshops also ensure a broad support for the strategy developed which eases implementation.

Step 4: Transition Roadmap & Scenario Building

- Instead of focusing on short-term ESG reports, SiD develops a transition roadmap spanning 20-30 years.

- This includes multiple future scenarios—accounting for changes in regulations, market dynamics, and environmental challenges.

- The roadmap is dynamic—adjusting to new information and ensuring continuous adaptation rather than rigid reporting cycles.

Step 5: Implementation & Feedback Loops

- Sustainability is embedded into daily operations, procurement, production, finance, and governance—rather than being an isolated CSR initiative.

- Organizations establish real-time feedback loops to track performance and course-correct when needed.

- Continuous learning ensures that sustainability remains an active strategy, not just a one-time policy, and generates shared ownership across the organization, not just by the sustainability officer or department.

The Result?

A sustainability strategy developed through SiD leads to:

✔ Genuine business transformation, not just ESG disclosure.

✔ Resilient, regenerative operations that future-proof the company.

✔ Alignment with real-world sustainability needs, not just investor preferences.

✔ Competitive advantage in a circular, low-carbon economy.

To summarize: What Do They Achieve?

ESG Strategy Outcomes

- Transparency for investors, compliance with regulations.

- Risk mitigation, brand reputation management.

- Potential unintended consequences: greenwashing, reporting fatigue without meaningful action.

Sustainability Strategy Outcomes

- Structural business transformation towards a regenerative model.

- Alignment with real-world sustainability needs, not just compliance.

- Competitive advantage in a future-proof economy.

- Tangible, measurable impact on planetary and societal health.

5. Next steps to build a sustainability strategy

Many companies start with an ESG strategy, believing it is the path to sustainability—only to realize later that compliance alone does not drive real change. Transitioning from an ESG mindset to a true sustainability strategy requires shifting from box-ticking and investor reporting to systemic transformation and long-term resilience.

So how can companies take this step, and what does it mean in terms of cost, effort, and impact?

First, there has to be an understanding and commitment on c-suite level about the importance of a sustainability strategy. It cannot be executed without approval and buy-in from the management level. Any sustainability offer wanting to pursue such a course first has the challenge to achieve this buy-in. Perhaps sharing this article with colleagues helps? 🙂

A valuable insight in this effort to convince colleagues can be that building a sustainability strategy is often more cost effective than following an ESG pathway. Setting up a ESG reporting trajectory for a medium size company ranges between $150.0000 and $250.000 within the first year, and demands at least 1 FTE to manage this, as well as participation of employees throughout the organization to supply data. This budget at least doubles when engaging a large accountancy or upmarket consultancy.

A sustainability strategy however, when following SiD, can start for less than the ESG reporting trajectory. In terms of management, it requires less than 0.5 FTE on the managing officer, and only several instances of peak involvement in the co-creation sessions throughout the first year. While it does not automatically result in a published report, it does result into a broad understanding of the long term strategy of the business by the internal team, and the co-creation sessions serve doubly as team building events.

Practical steps to get started:

1. Expand Your Perspective Beyond ESG Reporting

- Read up on various strategies available, including all the free SiD articles, books and video training, as well as the Framework for Strategic Sustainable Development (FSSD).

- Learn from powerful case studies that result from following a sustainability strategy, such as the IKEA Paper Revolution, and the clothing company Patagonia’s sustainability strategy. Also listen to this podcast from Dr. Maria Hoffacker that discusses the IKEA journey and others.

2. Use Systemic Tools Like SiD

- There’s plenty of help out there. The ThinkSiD.org website was created by the team at Except as a central resource to collect all SiD materials, which are all open-source and freely available. The SiD quickguide is an easy way to start, and to dive in deep, the SiD Omnibus, with its 450 pages and 20+ case studies, is the most complete sustainability strategy resource that can be found.

- One thing to remember is that while ESG frameworks can be complex and confusing, typically, sustainability strategy trajectories are relatively straightforward. The challenge is, however, that while the trajectory is straightforward, there’s a lot of aspects to investigate. Therefore, it is not so much that the content is difficult, it is just that it can be a lot of content. Managing this volume is the challenge rather than anything particularly difficult.

3. Engage the Whole Organization

ESG strategies are often siloed within compliance teams. Sustainability strategy encourages and enables full company engagement—from leadership and strategy teams to HR, R&D, and supply chain managers.

A first step into a sustainability strategy development is often to train a team in your company to become familiar with systems thinking & sustainability leadership. Very often in our practice we recommend this as the first step into the process. This can also be the first step into involving employees in co-creating sustainability initiatives rather than just reporting on ESG metrics.

4. Define Context-Based, Science-Driven Goals

- If you are already in an ESG trajectory, you can bring it a few steps closer to a sustainability strategy by ensuring the ESG goals are set with society’s needs in mind, such as the ‘triple materiality’ approach, also called ‘context based’ goals. Unlike ESG’s self-determined targets, sustainability strategies use scientifically defined, context-based goals (e.g., actual carbon budgets, circularity principles, social equity benchmarks). To get started with this, the UNRISD’s Sustainable Development Performance Indicators (SDPI’s) are a great tool. These also fit into the SiD process.

5. Develop a Long-Term Transition Roadmap

- The most important output of a sustainability strategy is a long term transition roadmap. A SiD-based roadmap looks beyond immediate reporting cycles to transform the company over decades. It helps to identify systemic leverage points for change, and boost the company into a new generation and era of development. This is closely tied to the company’s core operations, abilities, and strengths.

- Developing a transition roadmap requires the navigation between a traditional inside-out perspective of what the company can do, what it wants to achieve, and where its impacts lie, and a systemic outside-in perspective that reveals what the needs of society are, and how the company can help transition the ecosystem that it is in into a sustainable future. By combining these two, a company can grow into a truly contributive driver of a sustainable future, and derive value from doing so.

Last but not least: get the right kind of support

If you need your bike fixed, go to a bicycle repair shop, and not to a bakery. Similarly, if you need help with developing a sustainability strategy, go to experts on sustainability strategy and not to ESG service agencies. One can’t blame the big 4 for wanting to make money, but if you walk into a bakery, you’re not going to walk out with a fixed bicycle.

At Except, we have over 25 years of experience in supporting organizations building a sustainability strategy, from small family businesses to international giants such as Heineken and IKEA. We’re here to support you, and happy to chat with you if you need guidance.

Jan. 31, 2025